What is Opex (Operational Expenditure)? A Definition from TechTarget.com

[ad_1]

What is Opex (operational expenditure)?

Opex (operational expenditure) is the dollars a enterprise or business spends on an ongoing, day-to-day foundation to run its business. These expenses can be 1-time or recurring. Dependent on the industry, these bills can variety from the ink utilized to print paperwork to the wages personnel are paid out. Businesses may well also pay back for cloud computing expert services and vehicle leasing out of Opex.

Opex features selling, general and administrative expenditure, which are fees incurred by means of the most important business functions, or overhead. Opex excludes the price tag of goods sold (COGS), which are expenses straight attributable to the generation and gross sales of specific goods and solutions, like raw resources and parts.

Opex is used to determine operating income, which is then made use of to work out internet profits — or the bottom line — as demonstrated in the adhering to formulation:

Gross income = revenue – COGS

Operating cash flow = gross earnings – OPEX – depreciation – amortization

Web earnings = running profits – fascination – taxes

Income margin is then calculated as follows:

Gross income margin = gross earnings / profits

Running financial gain margin = running profits / income

You will find often an oblique correlation involving Opex and the inventory selling price of a company. When organization functions keep the exact same level of output and good quality, while decreasing Opex, the revenue margin improves. For that reason, the total value of the organization also improves.

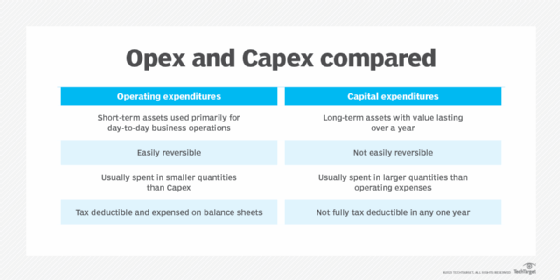

What is the distinction between Opex and Capex?

When a company wishes to purchase one thing, it can obtain it out of Opex or capital expenditure (Capex). Opex is made use of for smaller, a single-time or often transpiring expenses Capex is employed for substantial, one-time expenditures.

Operational expenses are mentioned on revenue statements and can be deducted for the yr in which the expenditures happened. Money expenses are put in on the improvement or acquire of fastened assets. Capital expenditures are listed on a company’s harmony sheet — or in a income movement assertion when they are considered as investments. Capex usually cannot be right deducted from taxes. Having said that, mounted assets can be depreciated about time to distribute out the expenditure around the practical existence of the property.

Operational expenditures are normally scaled-down, routinely taking place bills that a reduce-stage supervisor can approve. Cash expenses are typically for key buys intended to be employed prolonged time period and commonly require acceptance better up in the corporation.

Cloud computing providers are typically bought by means of Opex, which provides overall flexibility. A fork out-as-you-go pricing model doesn’t lock a corporation into a extensive deal. A organization only pays for what its end users take in fairly than a specified volume of resources.

What are some examples of Opex?

Opex focuses on the pursuing day-to-working day organization bills:

- products leases

- lease

- experienced expenses

- license costs

- payroll

- energy and gasoline

- online and mobile phone services

- cloud computing companies

- car leases

- residence taxes

- vacation expenditures

What are some illustrations of Capex?

Capex falls into two categories: tangible and intangible belongings. Tangible property refer to products a individual can physically touch, these as equipment, while intangible assets include products of benefit that cannot be touched, these types of as logos. Capex examples include the subsequent:

- real estate

- land

- structures

- furniture

- pcs

- software other than application as a provider

- machinery and tools

- vehicles

How do the foremost public cloud providers stack up? Understand what functions AWS, Microsoft and Google give, as nicely as pricing.

[ad_2]

Supply link Operational expenditure, often referred to as OPEX, is the ongoing expenses to a company that they incur while running their business. OPEX covers a broad range of expenditures, including employee salaries and benefits, marketing and advertising, rent, utilities, inventory costs and office supplies.

According to TechTarget.com, the definition of OPEX is “a type of expenditure that an organization incurs through its normal business activities. OPEX typically include costs that are recurrent or fixed in nature such as rent, electricity, depreciation, and other similar operating costs.”

Businesses have a responsibility to budget and manage their OPEX in order to maintain their company operations and remain profitable. Generally, businesses are expected to track their OPEX and ensure that their costs are in line with the industry.

Comparing the OPEX of a company to its competitors can help management identify areas that can be optimized to achieve more cost efficiency. A business can also assess its revenue and calculate the return on their OPEX, which allows them to make financial decisions that will help them maintain their operational efficiency.

OPEX is a vital component of any company’s financial health, and it is important to understand what it is and how to budget for it correctly. By understanding the core functions of OPEX, businesses can make well-informed decisions that will help them to remain competitive and profitable.